Supply Chain Risk Management

[formerly riskmethods]

Proactively monitor, identify, assess and mitigate supply chain risk.

Proactively monitor, identify, assess and mitigate supply chain risk.

Finding ways to become more risk aware, react faster and manage against emerging disruptions and compliance requirements is critical to business continuity. Sphera Supply Chain Risk Management (SCRM) is your AI-powered solution for improving preparedness and establishing a single source of truth for handling risk across your entire organization.

Through the power of AI, Sphera SCRM (formerly riskmethods) can identify supply chain risk and enable you to implement timely countermeasures ensuring a greater degree of resiliency in your supply chain.

Risk Radar leverages the power of artificial intelligence to profile and monitor your supply network to reveal risk in real time. Combined with premium and internal data sources, Risk Radar helps establish a common risk scorecard framework across your enterprise for countering supply chain threats more proactively while avoiding the costs of supply chain disruption.

Impact Analyzer helps you to minimize the business impact of risk by assessing suppliers’ criticality and detecting vulnerabilities at the category level. Adding impact dimensions like revenue and spend allows you to assess the extent of damage that a potential supplier failure could have on the supply chain. This also helps you select the suppliers that are best for your business.

Action Planner helps you collaborate across your organization and with your suppliers to orchestrate the tasks needed to both proactively and reactively mitigate risk. Use pre-built and customizable action plans, so you can quickly take action before incidents become critical.

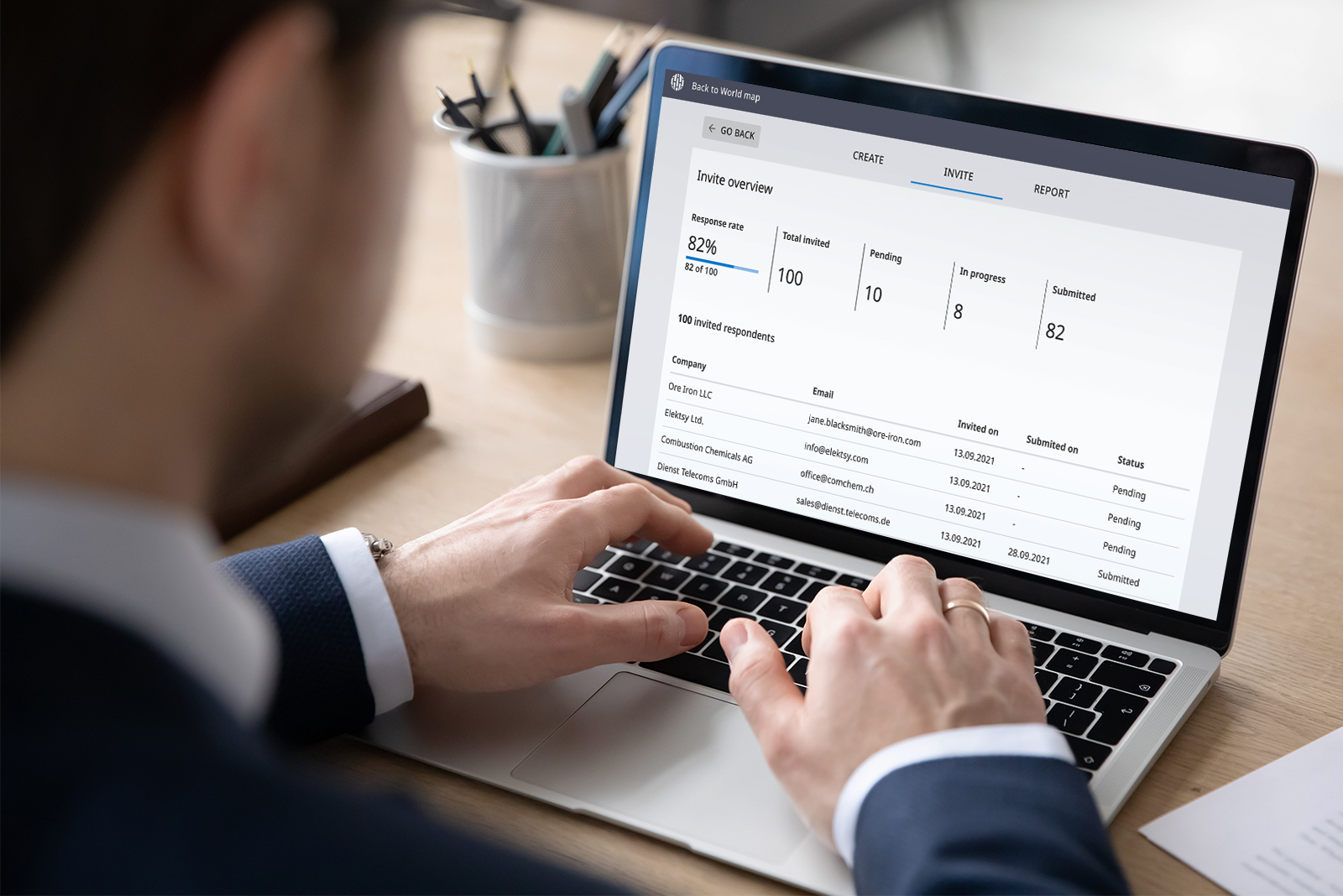

Risk Assessment automates supplier and third-party assessment processes, enriches evaluation of risk scores and integrates survey results into business partners’ risk profiles. Our versatile supply chain assessment tool simplifies supplier qualification and monitoring, improves data accuracy, reduces manual data collection and closes the risk feedback loop.

Compliance Incident Management (CIM) captures all relevant incident data. CIM comprehensively checks your supply chain for compliance-related violations and can be customized with company-related specifics. This enables you to monitor supply chain incidents that may violate regulatory requirements or internal sustainability goals and put you at greater financial or reputational risk.

Sub-Tier Visibility visualizes the process of monitoring and alerting n-tier supply chains within the Sphera Supply Chain Risk Management solution. With supplier-validated supply sites, you can confidently map sub-tier dependencies and more accurately expose threats in your sub-tiers before they become critical.

Elevate your supply chain risk management strategy in 2024 with the compliance power of Sphera SCRM ESG Bundle. One subscription gets you everything you need to proactively identify and mitigate ESG-related risks in your supply chain, craft customizable action plans and collect compliance-ready data to support reporting.

Commodity Risk Tracker enables companies to monitor their most critical commodities to optimize sourcing results. With Commodity Risk Tracker companies are the first to learn of disruptions in crucial commodities and gain competitive advantage.

Find out how Sphera Supply Chain Risk Management software enables a proactive approach to supply chain risk.

Protect your business by quickly detecting risk. Profile and monitor your supply network to reveal risk in real time.

Prevent risk from costing you by mapping disruptions to suppliers concentrated in regions impacted by geopolitical crisis or natural disasters.

Save valuable time by making the right decisions by collaborating both across your organization and with your suppliers to proactively mitigate risk.

Risk can be best managed by what you see. But for certain areas of your risk exposure, your third parties are the only ones who can provide the answers.

Work with tier-1 suppliers to visually map dependencies and expose threats in your sub-tiers before they become critical.

Purchasing and supply chain leaders from companies you know run on Sphera SCRM software to manage and mitigate risk.

We are pleased to introduce the inaugural Sphera Supply Chain Risk Report. This report explores the risks that threatened enterprises and suppliers the most in 2023, as well as their causes and consequences. We also investigate relevant events and look at real-life examples to illustrate how risk develops.

On Avg. SC disruptions cause 4.2% EBITDA loss per year.

79% report 4% or more of revenue was lost to supply chain disruptions over the past 3 years1.

Only 15% have visibility into tier-2 and beyond1.

35% of respondents have 1 to 4 days typical response time to a risk event1.

Learn what Sphera’s Supply Chain Risk Management software can do for your enterprise.